Table of Contents

01

of 13

Introduction

People nowadays are passionate about the cryptocurrency world, and many of them wonder what Bitcoin halving is. This is a detailed guideline comprising all the aspects of Bitcoin halving, telling you what it is, why it is essential, and how it contributes to the entire cryptocurrency market. Let’s distinguish the secrets of how this considerable event happens in the world of Bitcoin.

02

of 13

What is Bitcoin?

Bitcoin is a type of digital currency in which a record of transactions is maintained and new units of currency are generated by the computational solution of mathematical problems, and which operates independently of a central bank. In 2008, the mysterious Satoshi Nakamoto released Bitcoin – the pioneering decentralized digital currency. Bitcoin utilizes blockchain tech – a transparent, secure, unchangeable distributed ledger.

03

of 13

What is Bitcoin Halving?

Bitcoin halving is a rather strict process that happens every four years. In simpler words, it is the process of halving miners’ rewards for new blocks being created in the Bitcoin blockchain. The whole concept contributes to Bitcoin’s supply reduction and safeguards the coin’s rarity in the world. Precisely, this process is aimed at controlling inflation: and ensuring the gradual release of new coins into circulation.

04

of 13

What is the significance of Bitcoin Halving?

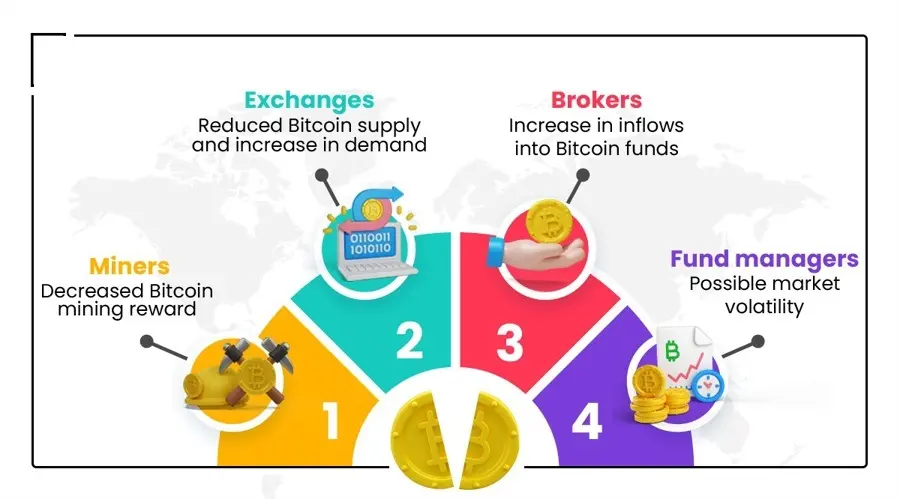

As stated earlier, Bitcoin halving directly influences Bitcoin economics. It means reducing miners’ rewards would decrease the new coins’ supply, causing a decline in the Bitcoin creation speed. In other words, it results in producing some scarcity which would eventually increase Bitcoin demand and, in turn, its worth over time. For these reasons, Bitcoin Halving is of great importance to Bitcoin-focused investors, traders, and even followers as it could significantly affect the Bitcoin price.

05

of 13

Bitcoin Halving – The History

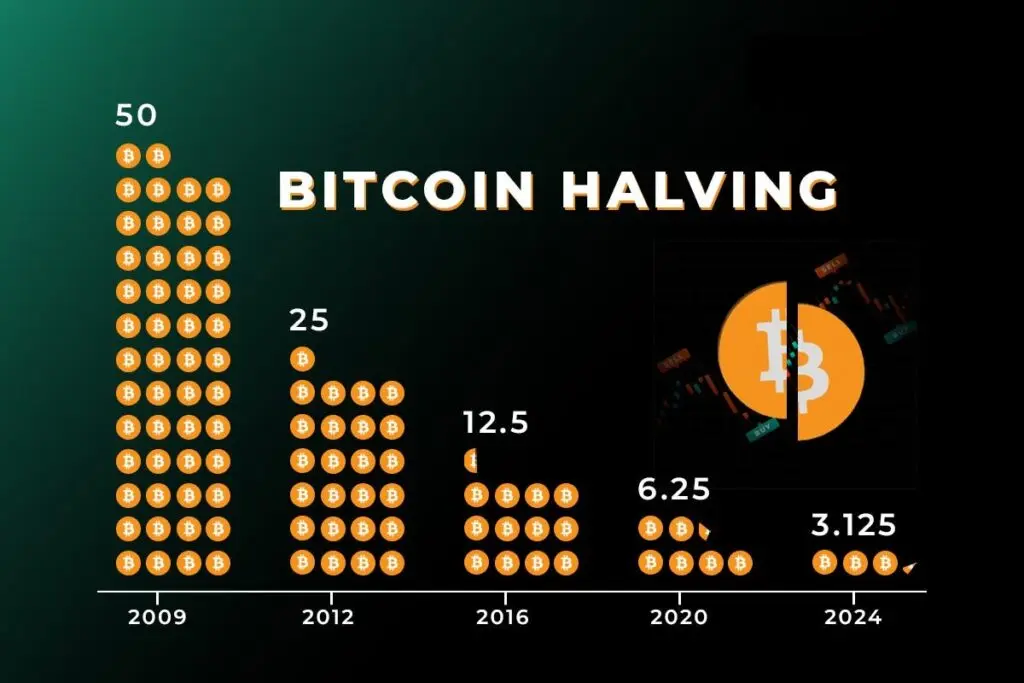

Bitcoin has experienced three halving events since the establishment of the cryptocurrency. The first event took place in November 2012, the second one in July 2016, and the third one in May 2020. In each case, before and after such events, there were lots of discussions regarding the possible negative, positive, and no-price effects of Bitcoin due to the declined block rewards. Considering the past adventure with Bitcoin halving events can be useful to understand better what is likely to happen to the market.

06

of 13

Halving Mechanism

Bitcoin halving’s mechanism stems from the cryptocurrency’s underlying code. Eve ry 210,000 blocks mined (roughly four years), Bitcoin’s block reward halves. Initially, miners receive 50 Bitcoins per block. After the first halving in 2012, this dropped to 25 Bitcoins. The second halving in 2016 reduced the reward to 12.5 Bitcoins. The next halving is anticipated in 2024, further slashing the reward to 6.25 Bitcoins.

07

of 13

Mechanism of Bitcoin Halving

The reason behind Bitcoin’s halving is built into its code. On average, a new block is added to the blockchain every 10 minutes through mining. Miners race to solve very hard math problems. The first miner to solve the problem gets to add the next block. As a reward, that winning miner receives some Bitcoin.

08

of 13

The Role of Bitcoin Halving

Bitcoin halving is an event that happens around every four years. It happens after 210,000 blocks are mined on the blockchain. During this halving, the reward that miners receive for validating transactions gets cut in half. At first, miners got 50 BTC per r block. Then it went down to 25 BTC. After that, it became 12.5 BTC. This pattern continues, halving each time.

09

of 13

Significant Events Shaped Bitcoin’s Journey

Bitcoin encountered pivotal halving occurrences thrice since its birth. Initially, in November 2012 witnessed this phenomenon, subsequently unfolding in July 2016 and May 2020. These milestones garnered substantial media coverage, market fluctuations intensified, and speculation about Bitcoin’s prospects surged. However, the essence remained unaltered, with Bitcoin persevering through these pivotal junctures.

10

of 13

Consequences on the Market

Bitcoin’s halving sparks lots of discussion and speculation. Some say it cuts Bitcoin’s inflation rate, making it rarer and boosting value later on. But others argue past halving we were already priced in, so prices didn’t change much.

11

of 13

Mining Dynamics

Halving profoundly affects the economics of Bitcoin mining, the process by which new coins are created and transactions are validated. As the block reward diminishes, miners must rely increasingly on transaction fees to sustain their operations. This dynamic incentivizes efficiency improvements in mining hardware and fosters competition among miners to secure block rewards.

12

of 13

Bitcoin’s Supply Drop Affects Markets

Before and after Bitcoin halving, the crypto market gets rocky. This halving cuts the rewards miners receive, so the amount of new Bitcoin entering ring circulation drops. Investors switch tactics as the supply-demand balance shifts, causing Bitcoin’s price to swing up and down wildly. This volatility brings chances and dangers for traders who watch the shifting market.

Bitcoin halving can make Bitcoin’s price steady for some time, as traders get used to the new supply rules. It often leads to a period of consolidation and stabilization in price.

Some investors think halving is good. They believe Bitcoin’s price will increase later because there will be less new supply. With reduced supply coming, the existing supply becomes more valuable.

Others don’t think the halving matter is much. They argue that traders have already factored in the reduced rewards. So, the impact is already priced into Bitcoin’s current value.

“Bitcoin’s supply getting cut in half is a massive change. It could significantly impact Bitcoin’s price in big ways, whether up or down.”

13

of 13

Conclusion

Bitcoin halving impacts the crypto market in a big way. By knowing halving basics, investors navigate the market’s ups and downs better. They make smarter choices about their crypto investments. As Bitcoin goes mainstream, halving vents will shape digital currency’s future more. Stay informed about halving. Research carefully before investing in Bitcoin’s volatile market.