Observer Time: October 11, 2024

Tesla Flop Event: Analysts observed Elon Musk’s amusing presentation of his technology while noting that the company had neglected to disclose pricing and regulatory plans for Cybercab.

Following the highly publicized robotaxi event the company’s stock exhibited a significant decline.

According to him, it is not easy to revise the 2025/2026 estimates with confidence, and many investors were expecting more concrete results due to this occurrence.

Potter acknowledged that Elon Musk’s commentary may not be a reliable source for investors.

So today here at Observer Time we will discuss and observe the news of robotaxi flop event.

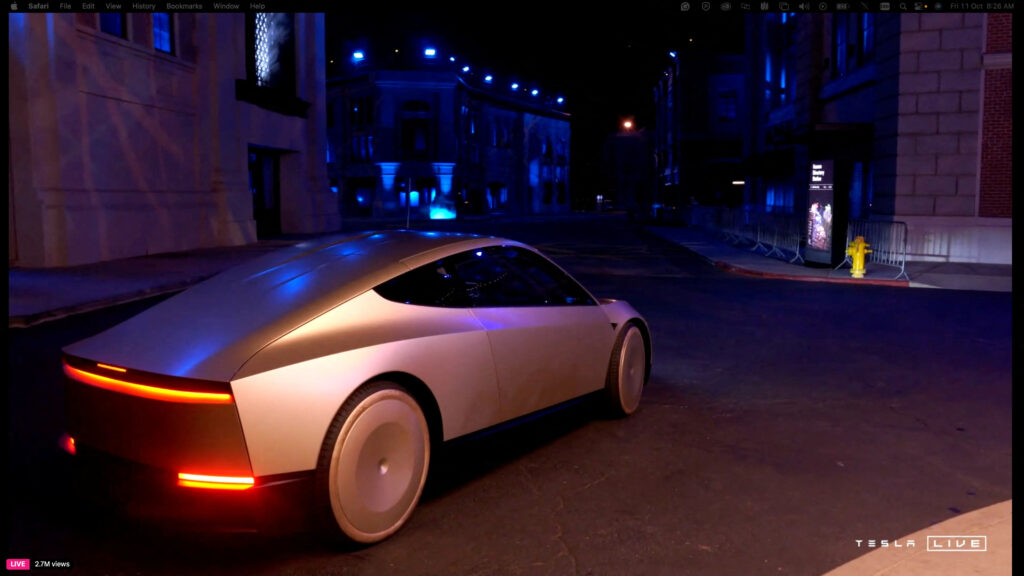

TESLA ROBOTAXI EVENT

According to him, Elon predicts the Cybercab by 2026, but it is unlikely to become available until at least 20, despite still maintaining a buy rating and aiming for 310p/d as per his target price.

Additionally, Potter stated that the robotaxi service’s pricing and other business models were not disclosed, but he found the Cybercab’s price of approximately $30,000 to be fascinating.”

Tesla shares are off about 6% in premarket trading Friday.

William Blair’s spokesperson, Jed Dorset, pointed out a discrepancy between announcements that he considered very impressive and their potential to influence shares in the short term.

Taking over all Warner Bros., Tesla held their most ambitious and impressive event yet with “‘We… Robot. He stated that he intends to transform the town sets of Studio into a futuristic theme park with multiple attractions, entertainment, and Tesla Easter eggs scattered throughout the area.

Despite the event and tech being impressive, Dorsheimer’s takeaway message is that they can only make sense of the short-term vision for the bears.

Analysts have viewed Tesla’s decision to avoid a low-priced Model 2 car as advantageous for the company struggling to remain competitive.

While anticipating a sell-the-news response to its event, Mr. Abbas believed that companies such as Nike and Microsoft could make significant earnings contributions today by taking advantage of the opportunity.

Bernstein analyst Toni Sacconaghi, who has a positive view of its shares, stated that the “We, Robot” event was underwhelming and had notably limited details.

According to Sacconaghi, investors were left with questions that included the necessary steps for obtaining regulatory approval or understanding the claimed cost per mile of Tesla’s Cybercab.

The event confirmed Tesla’s ability to win in FSD/Robotaxis and make substantial, large profits, as we believe it will be a challenging task, with particular attention to the semi-driving technology.

Despite facing technical and regulatory obstacles, Sacconaghi wonders if it will be able to surpass current robotaxi operators.

He also believes that even achieving Level 5 autonomy before rivals would limit the opportunity for it by closing such gaps. At level 5 autonomy, the car would be able to drive itself.

Uber’s stock has been overvalued by the Tesla event, but the Bernstein team believes that the industry’s upcoming presentation supports its view that autonomous vehicle ownership is a long-term endeavor.

Stock market participants are feeling the benefits of Uber’s 5% gain in Friday’s stock exchange trading, as they are confident that Tesla’s announcement won’t put their company under immediate threat.

“Tesla’s Robotaxi Day is one of Uber’s biggest hurdles to overcome after it posted strong second-quarter results, as it improved its credit rating and received favorable regulatory results in California,” wrote Tim Bernstein.

For regular updates subscribe to the newsletter of Observer Time