Table of Contents

01

of 08

Cryptocurrency

Cryptocurrency is a digital payment system that doesn’t rely on banks to verify transactions. It’s a peer-to-peer system that can enable anyone anywhere to send and receive payments. Instead of being physical money carried around and exchanged in the real world, cryptocurrency payments exist purely as digital entries to an online database describing specific transactions. When you transfer cryptocurrency funds, the transactions are recorded in a public ledger.

02

of 08

How does it work?

Cryptocurrency is stored in digital wallets. Cryptocurrencies run on a distributed public ledger called blockchain, a record of all transactions updated and held by currency holders.

Units of cryptocurrency are created through a process called mining, which involves using computer power to solve complicated mathematical problems that generate coins. Users can also buy the currencies from brokers, and then store and spend them using cryptographic wallets.

If you own cryptocurrency, you don’t own anything tangible. What you own is a key that allows you to move a record or a unit of measure from one person to another without a trusted third party.

Although Bitcoin has been around since 2009, cryptocurrencies and applications of blockchain technology are still emerging in financial terms, and more uses are expected in the future. Transactions including bonds, stocks, and other financial assets could eventually be traded using the technology.

03

of 08

How many cryptocurrencies are there in the world?

The first cryptocurrency was Bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion.

| Month, Year | Number of Cryptocurrencies |

| April 2013 | 7 |

| January 2014 | 57 |

| January 2015 | 501 |

| January 2016 | 572 |

| January 2017 | 636 |

| January 2018 | 1,359 |

| January 2019 | 2,086 |

| January 2020 | 2,403 |

| January 2021 | 4,154 |

| January 2022 | 8,714 |

| January 2023 | 8,856 |

| January 2023 | 9,002 |

| March 2024 | 13,217 |

04

of 08

Top 10 Cryptocurrencies In The World:

1. Bitcoin (BTC):

- Market cap: $1.2 trillion

- Year-over-year return: 108%

2. Ethereum (ETH)

- Market cap: $358.3 billion

- Year-over-year return: 61%

3. Tether (USDT)

- Market cap: $110.6 billion

- Year-over-year return: 0%

4. Binance Coin (BNB)

- Market cap: $82.7 billion

- Year-over-year return: 74%

5. Solana (SOL)

- Market cap: $61.5 billion

- Year-over-year return: 543%

6. U.S. Dollar Coin (USDC)

- Market cap: $33.1 billion

- Year-over-year return: 0%

7. XRP (XRP)

- Market cap: $28.6 billion

- Year-over-year return: 14%

8. Dogecoin (DOGE)

- Market cap: $19.0 billion

- Year-over-year return: 69%

9. Toncoin (TON)

- Market cap: $16.8 billion

- Year-over-year return: 131%

10. Cardano (ADA)

- Market cap: $16.2 billion

- Year-over-year return: 19%

05

of 08

Binance Cryptocurrency

The Binance Exchange is a leading cryptocurrency exchange founded in 2017. It features a strong focus on altcoin trading. Binance offers crypto-to-crypto trading in more than 350 cryptocurrencies and virtual tokens, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dogecoin (DOGE), and its cion binance coin (BNB).

Binance is a great call in the domain of digital currency, famous for its wide cluster of administrations, global reach, and innovative method. Established in 2017 by Changpeng Zhao (CZ), Binance has become one of the largest and most persuasive cryptographic money trades on the planet. It offers an easy-to-recognize interface and a sturdy alternate motor that empowers clients to buy, promote, and change a broad determination of cryptographic cash suits. Binance is also recognized for its devotion to security, making use of encryption, -factor validation (2FA), and bloodless ability answers for placing away digital currencies.

Binance Coin (BNB) is a basic part of the Binance environment, serving distinct skills at the level, such as the installment of exchanging costs, cooperation in symbolic offers on the Binance Platform, and attending to top-class factors like Binance Savvy Chain.

Binance has extended its contributions beyond digital cash change, offering a scope of extra administrations, such as Binance Procure for acquiring hobby in inactive crypto assets, Binance Investment price range for adaptable and fixed-time period crypto reserve funds items.

06

of 08

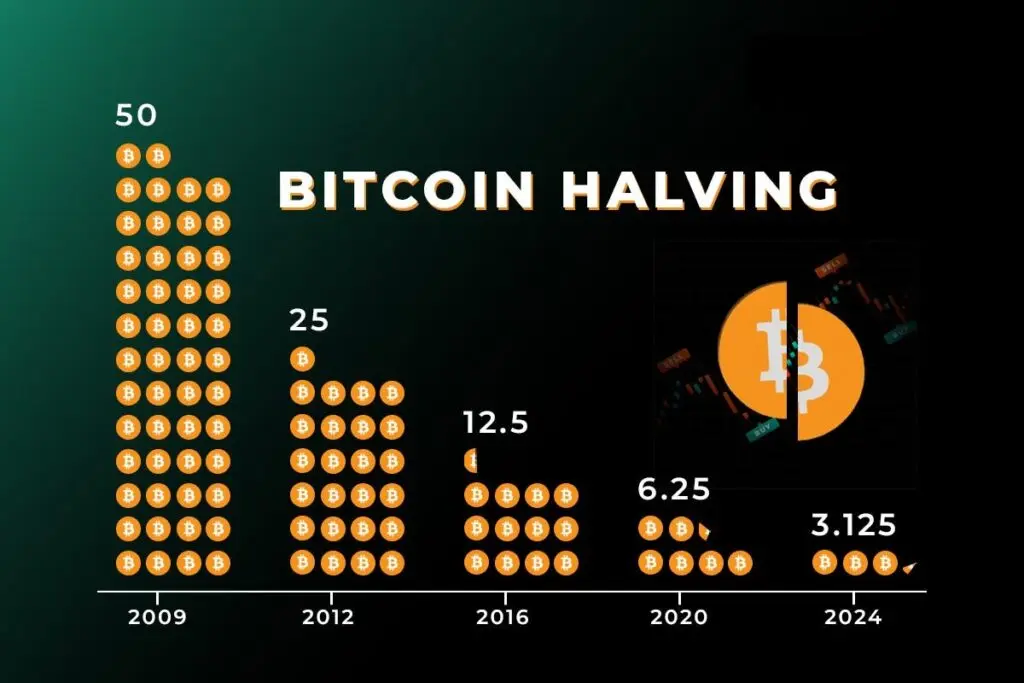

Bitcoin Halving

Bitcoin halving is a rather strict process that happens every four years. In simpler words, it is the process of halving miners’ rewards for new blocks being created in the Bitcoin blockchain. The whole concept contributes to Bitcoin’s supply reduction and safeguards the coin’s rarity in the world.

07

of 08

Some Incredible Facts to Know About Cryptocurrency

In the past few years, it has only gained a powerful influence on the global economy. The whole world rapidly drew attention to this original digital currency. So, with this article, you will learn exciting facts to enhance your education. Shall we?

The History of Cryptocurrency

The original cryptocurrency emerged in 2009, it was Bitcoin, of an unknown citizen or a union of citizens under the fictitious designation Satoshi Nakamoto. Was a self-regulating digit break, designed to bypass the worldwide financial system.

The second-largest cryptocurrency, Ethereum, was proposed by Vitalik Buterin in 2013 and went live in 2015. Ethereum was the first to suggest the idea of brilliant agreements, allowing decentralized applications to operate on its blockchain.

Market for Cryptocurrency

The market for Cryptocurrency is over-the-top volatile, with prices frequently changing over-the-top minutes. Length of speech: 1069 seconds. News concerning regulations, market sentiment, and technological novelty might move the market.

Just before now, starting around 2021, the total market value of all cryptographic forms of money of the union was over $2 trillion. Bitcoin has continued to be the most popular digital money, with a substantial market share.

Blockchain Technology and Safety

Cryptography protects cryptocurrencies, making them virtually impossible to counterfeit. Exchanges are recorded on a public record called the blockchain, guaranteeing straightforwardness and security.

The underlying infrastructure of cryptocurrencies, blockchain technology, is a decentralized system without intermediaries. This disseminated record framework improves effectiveness, straightforwardness, and confidence in exchanges.

The Use of Cryptocurrencies

Significant organizations like Tesla, Microsoft, and PayPal have begun tolerating digital currencies as a type of installment. This trend is evidenced by digital currencies becoming more mainstream and accepted.

Central Bank Digital Currencies, or CBDCs, are a concept being considered by some nations to issue their digital currencies. CBDCs could alter how legislatures oversee money-related arrangements and monetary exchanges.

Digital Currency Mining

The process of adding transactions to the public ledger and validating them on the blockchain is known as cryptocurrency mining. Miners are rewarded with newly minted coins after completing challenging mathematical puzzles using powerful computers.

There are environmental concerns regarding the carbon footprint of Bitcoin mining because it uses a significant amount of electricity. Endeavors are being made to foster more manageable mining practices and elective agreement instruments.

Trends in the Future and New Ideas

The decentralized finance (DeFI) sector is revolutionizing conventional financial services by providing borderless, permissionless access to various financial products. Users can borrow, lend, and trade assets without the need for middlemen on DeFI platforms.

Due to their capacity to represent ownership of unique digital assets like collectibles, music, and art, non-fungible tokens (NFTs) have gained popularity. NFTs are exchanged on blockchain stages, giving provenance and validity to computerized manifestations.

Legal Frameworks and Regulation

Different jurisdictions have very different regulations regarding cryptocurrency, with some embracing digital currencies and others imposing severe restrictions. Administrative lucidity is essential for encouraging development while guaranteeing buyer security and monetary steadiness.

Money laundering and fraud are two examples of illegal activities that are being investigated by governments and regulatory bodies. Regulations called “KNOW Your Customer” (KYC) and “Anti-Money Laundering” (AML) are being put into place to make the crypto industry more open and accountable.

Myths and Myths About Cryptocurrencies

Because transactions are recorded on a public blockchain, cryptocurrencies are not inherently anonymous but pseudonymous. This is contrary to popular belief. Security coins like Monero and Zcash offer upgraded protection highlights for clients looking for obscurity.

The confusion that digital currencies are utilized principally for illegal exercises has been exposed by information showing that most exchanges are real and straightforward.

Culture and the Cryptocurrency Community

The crypto community is renowned for its innovative and passionate spirit, which drives the creation of novel projects and technologies. Online discussions, virtual entertainment channels, and gatherings play a huge part in cultivating coordinated effort and information sharing.

Crypto enthusiasts frequently participate in airdrops, a marketing and community-building strategy in which new projects give away free tokens to early supporters. Airdrops have the potential to entice prospective blockchain projects and reward devoted users.

Dangers and Security Difficulties

Cryptocurrencies are vulnerable to cyberattacks and threats to cybersecurity, with exchange hacks and wallet breaches posing significant dangers to investors. Secure capacity arrangements like equipment wallets and multi-signature wallets are prescribed to safeguard reserves.

In the crypto industry, phishing attacks, in which malicious actors pretend to be legitimate websites or services to steal sensitive information, are common. Before sharing personal information, users should exercise caution and confirm the legitimacy of websites and communications.

Monetary Incorporation and Strengthening

By giving people who don’t have access to traditional banking systems access to financial services, cryptocurrencies have the potential to bank the unbanked. Microfinance and peer-to-peer transactions have the potential to empower underserved communities and increase financial inclusion.

When compared to conventional banking methods, cryptocurrencies have the potential to provide faster, less expensive, and more inclusive solutions in the areas of remittances, cross-border payments, and micropayments. Ripple and Stellar, two blockchain-based platforms, are working to streamline international money transfers and cut fees.

Training and mindfulness

Programs that teach people about blockchain and cryptocurrencies are getting more and more popular. These programs offer classes and workshops that help people learn the basics of digital assets. Expanding mindfulness and information about digital currencies can enable clients to go with informed speculation and utilization choices.

In the cryptocurrency industry, scams and Ponzi schemes that target inexperienced investors are common, highlighting the need for caution and research. Investors should thoroughly investigate projects, check the qualifications of teams, and be wary of promises of unattainable returns.

Impact on the Environment

Concerns about cryptocurrencies’ effects on the environment and carbon footprint have been raised by the amount of energy they use, like Bitcoin. Confirmation of Work (PoW) agreement systems utilized in mining require huge computational power, prompting high energy utilization.

Landscape change and evolution

The cryptocurrency industry is being reshaped by new projects, technologies, and innovations as the landscape continues to rapidly change. Remain informed, adjust to arising patterns, and draw in with the local area to explore the unique universe of cryptographic forms of money.

“Cryptocurrency is not just a digital currency; it is a paradigm shift in the way we think about money and transactions” .

08

of 08

Conclusion

We gain a deeper appreciation for the complexity, innovation, and potential of digital currencies as we decipher these 26 fascinating facts about them. Cryptocurrencies are reshaping the future of technology and finance, transforming industries and causing volatile market dynamics. Embracing this computerized insurgency requires mindfulness, instruction, and a basic mentality to explore the potential open doors and difficulties that lie ahead. As we travel through the ever-changing world of cryptocurrencies, keep in mind to remain informed, secure, and curious.